Rates

Rate Notice

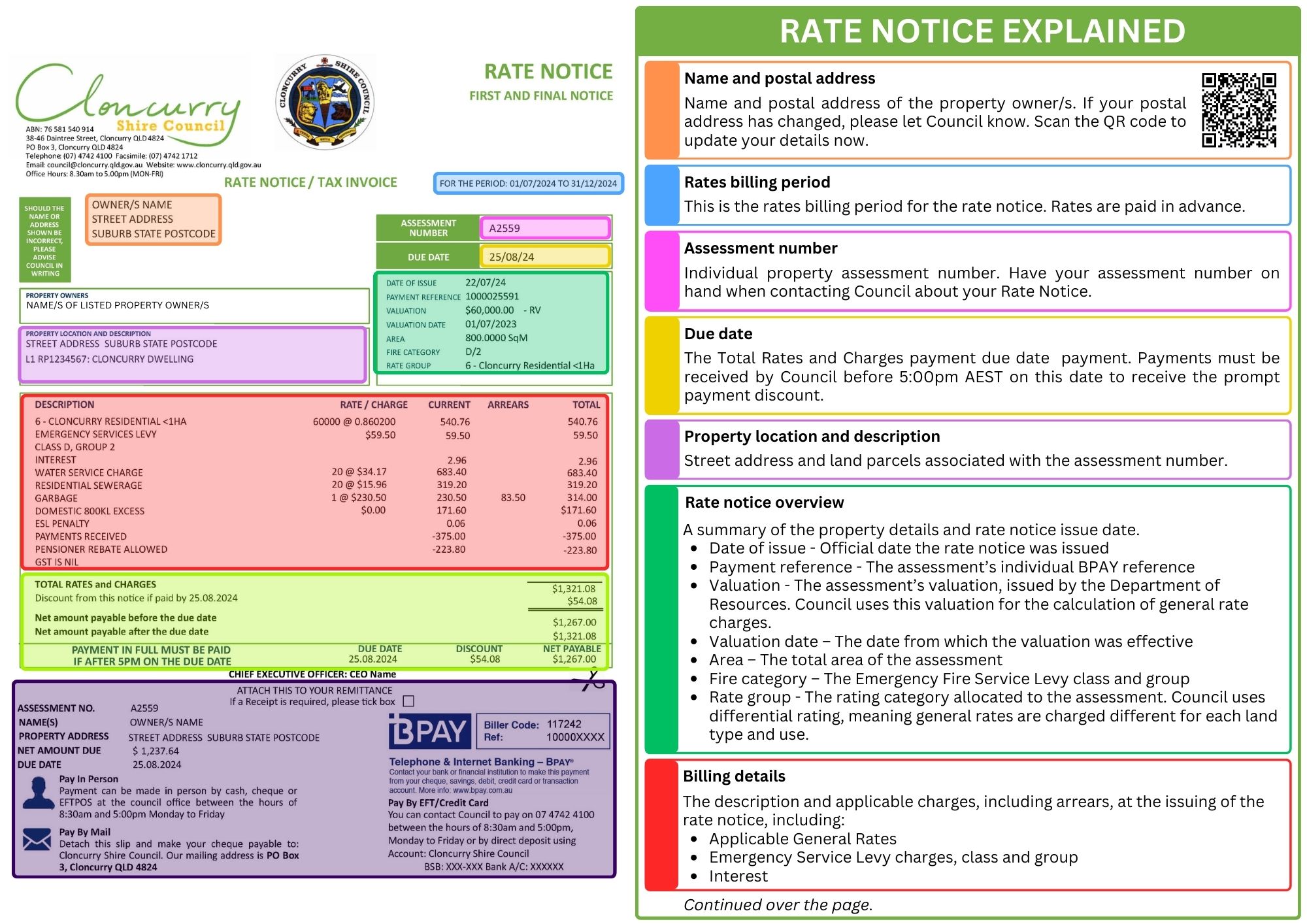

Under Section 94 of the Local Government Act 2009, Cloncurry Shire Council must levy general rates on all rateable land within the local government area.

Cloncurry Shire Council currently levies rates and charges half-yearly and allows for a prompt payment discount on the general rates charged when payments are received in full prior to 5:00pm on the due date listed on the issued Rate Notice.

In accordance with Section 130 of the Local Government Regulation 2012 a discount of 10% will be allowed by Council on the levy for the current year general rates if full payment of current (and any overdue rates, charges and interest) is received by no later than 5:00pm on the due date shown on the rate notice. The due date will be the last day any discount will be allowed, this being a minimum of 31 days from the date of issue of the Rate Notice.

The purpose of this discount is to encourage the prompt payment of the relevant rates and charges. The discount will only apply to general rates and will not be allowed on the State Government’s Fire Services Levy, utility charges, excess water charges or special rates.

To be entitled to the discount, ratepayers must ensure that payment of the levy amount in full net of the discount amount is credited to the Council’s bank account, if done by BPay or electronic fund transfer, or received over the counter at Council’s office, or received by its appointed agents, by 5.00pm on the due date specified on the Rate Notice.

The discount will NOT be allowed on payments received after 5.00pm on the due date applicable to each payment unless Council is satisfied that payment was not made by close of business on the due date due to circumstances for which the Council is responsible.

The discount will also NOT be allowed where a payment was lodged before the close of business on the due date but the transfer of the funds into the Council’s bank account or agent was not received by the close of business on the due date due to any delays by the payer’s financial institution or their agent or other similar reasons.

Discount disallowed on the first instalment of a levy is not eligible for allowance even if payment of a later levy is made by close of business on the specified due date for that levy.

No discount will be allowed if overdue rates/charges remain payable in respect of the property after payment of the current rates/charges.

Pursuant to the provisions of Section 132 of the Local Government Regulation 2012 Council will charge interest on all overdue rates and charges, including special and separate rates, at the maximum rate provided for by the Regulation.

At Section 133 of the Local Government Regulation 2012, the maximum interest rate applicable is provided.

For the 2024/25 financial year, any outstanding balances at the close of the discount period will incur simple interest at the rate of 12.35% per annum.

Water Meter Reading

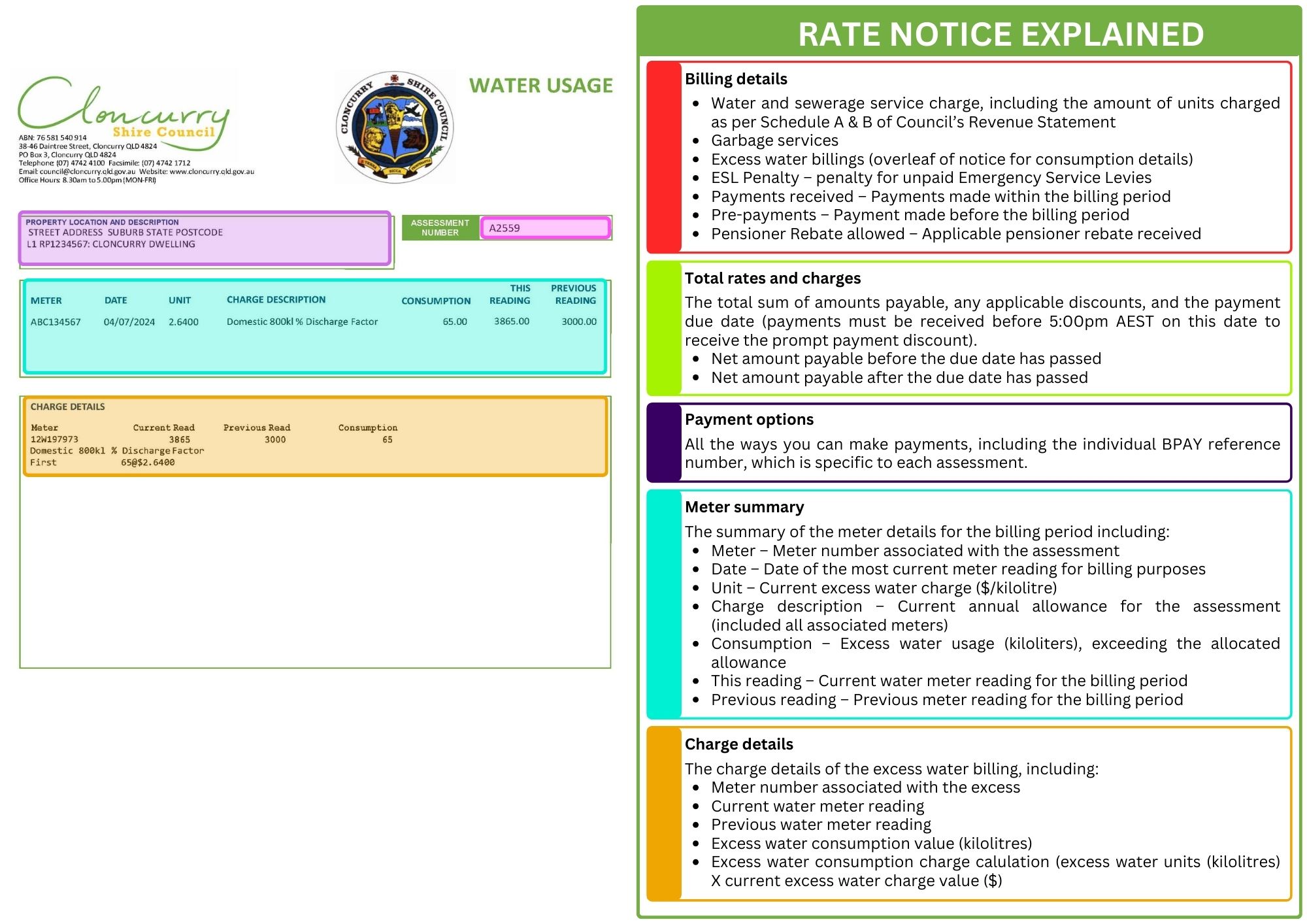

All water that enters your property from the town water supply is recorded on your water meter. Council water meter readings are conducted twice a year for residential and commercial properties.

Readings are scheduled for January and July. Council issues public notices online to advise ratepayers of upcoming water meter reads.

Water meters are usually located at the front of the property, on the far left or far right. If you’re having trouble finding it, please contact Council.

Water meters are installed by the Council and remain the property of the Cloncurry Shire Council. Ratepayers must notify Council of any maintenance required on a property’s water meter.

Regularly checking your water meter will help you be more aware of how much water your household uses and will help avoid any surprises at bill time. Water meters are generally read 6 monthly by Council, so it is important for the owners/occupiers of the property to check their water meter regularly to help identify maintenance issues and leaks.

The number embossed on your meter is the meter number and it should match the number on your rate notice.

To read the meter, flip open the small cover to reveal five white numbers and three red numbers. The white numbers are in thousands of litres (kilolitres or tonnes of water) and the red numbers are decimals — hundredths, tenths and litres.

It is the ratepayer's responsibility to ensure that the water meter on their property is accessible to meter readers (Council employees and/or contractors). Plants, grass, mulch and debris must be cleared away from the meter.

If meter readers cannot access the property’s water meter due to plant overgrowth, dogs at the property, or other factors, Council will issue a letter to the ratepayer to advise what needs to be rectified to achieve a successful meter read and a rescheduled time for the water meter read.

An allocated water allowance is the annual amount of kilolitres allowed for a metered assessment, which can be found on your most recent water rates notice or by contacting Council.

The annual allowance reflects the amount of water units billed each half-yearly rate notice, as per Council's Revenue Statement in Schedule A & B (e.g. 800kl is 20 units billed half yearly). Please note residential properties are referred to as 'dwellings' or 'vacant land' in the Revenue Statement schedule.

If you have exceeded your annual allowance, an excess charge will appear on your Rate Notice.

A courtesy letter is sent to the owner to track water usage if:

a) water usage is likely to go over the yearly allowance based on the most recent meter read

b) if water usage is under half of the annual allowance

Council occasionally conducts unscheduled water meter readings. If Council notices a substantial increase in water consumption, a courtesy letter will be sent to the ratepayer bringing the increased water consumption to their attention.

There are many reasons for high water consumption, which include:

- Changes to the number of occupants in the home

- Changes in weather (i.e. low rainfall)

- Establishing new lawns or gardens

- Filling or topping up pools

- Change in water habits

- Water leaks

- Faulty water meter

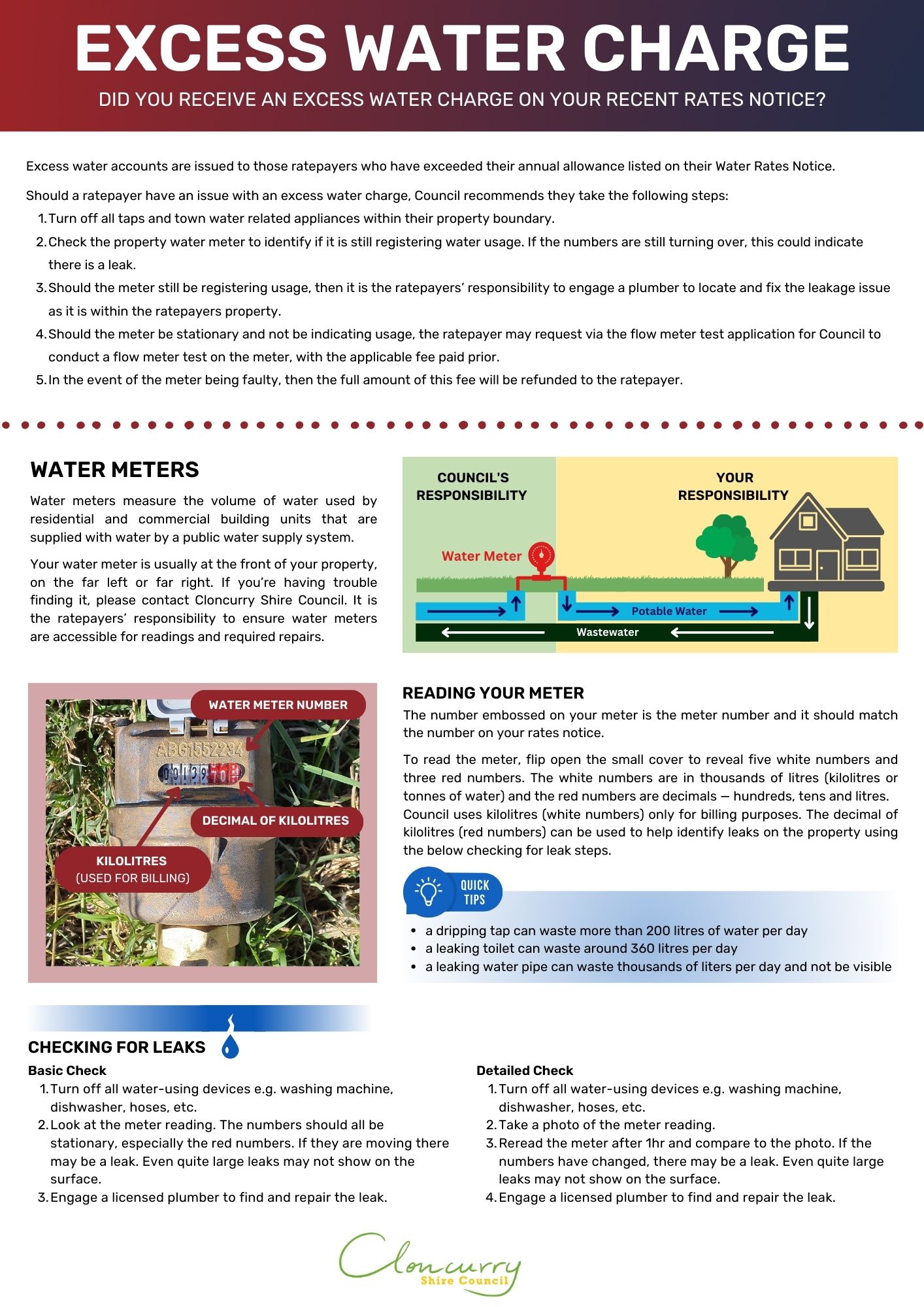

If a ratepayer has an issue with a water meter reading, Council recommends they take the following steps:

- Complete a leak test at your property

- If the test does not indicate there is a leak, the ratepayer may request a flow meter test via the Flow Meter Test application form. Council will conduct the test once the form is received and applicable fees have been paid.

If the water meter is found to be faulty, the fee will be refunded.

If you are unsure why your water consumption is so high, there are some tests you can run yourself to locate a potential leak.

Basic Check

- Turn off all water-using devices e.g. washing machine, dishwasher, hoses, etc.

- Look at the meter reading. The numbers should all be stationary, especially the red numbers. If they are moving there may be a leak. Even quite large leaks may not show on the surface.

- It is the ratepayer's responsibility to engage a licensed plumber to find and repair the leak.

Detailed Check

- Turn off all water-using devices e.g. washing machine, dishwasher, hoses, etc.

- Take a photo of the meter reading.

- Reread the meter after 1hr and compare to the photo. If the numbers have changed, there may be a leak. Even quite large leaks may not show on the surface.

- It is the ratepayer's responsibility to engage a licensed plumber to find and repair the leak.

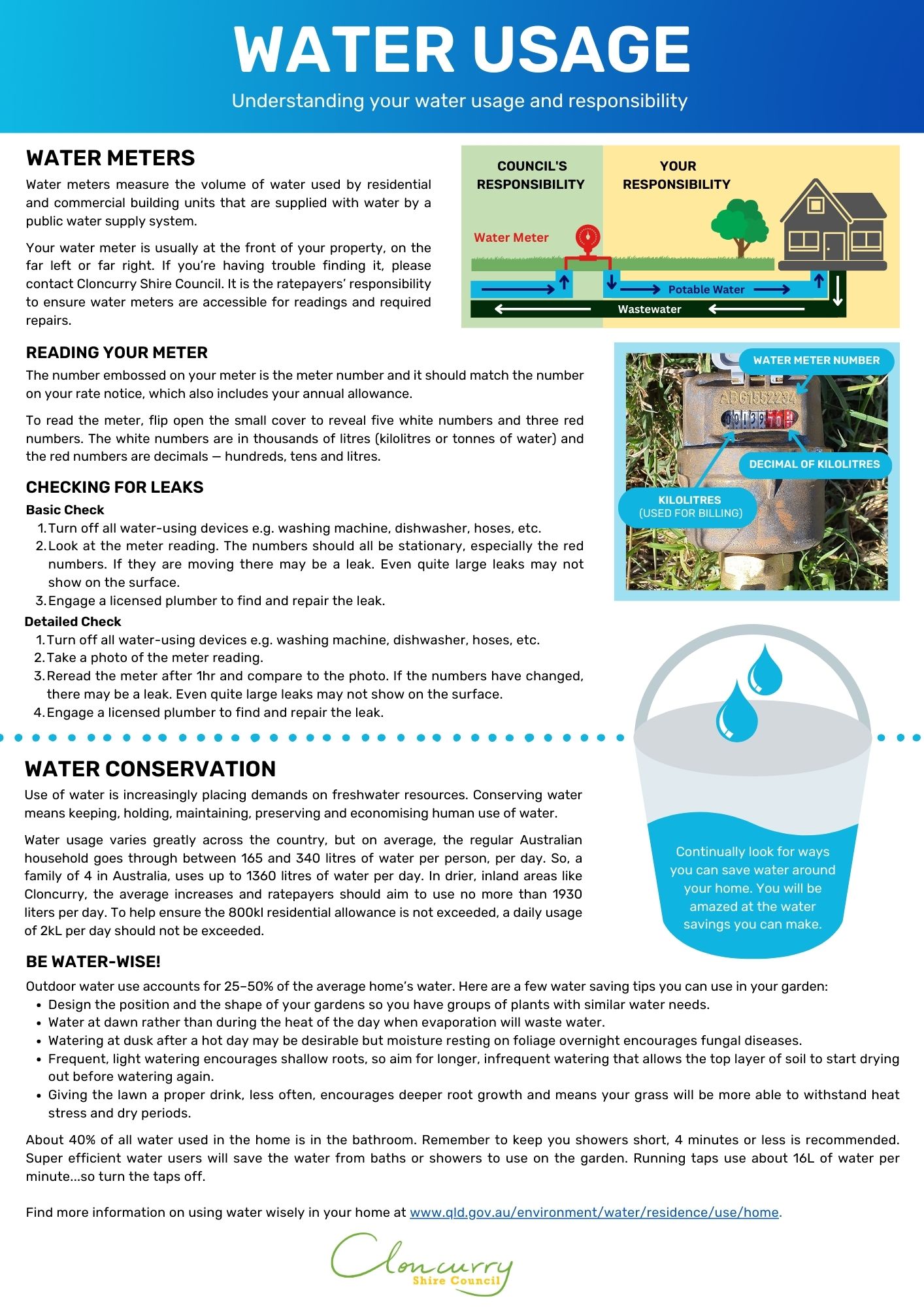

Water usage is placing increasing demands on freshwater resources. Conserving water means keeping, holding, maintaining, preserving and economising human use of water.

Water usage varies greatly across the country, but on average, the regular Australian household goes through between 165 and 340 litres of water per person, per day. So, a family of 4 in Australia, uses up to 1360 litres of water per day. In drier, inland areas like Cloncurry, the average increases and ratepayers should aim to use no more than 1930 litres per day. To help ensure the 800kl residential allowance is not exceeded, a daily usage of 2kL per day should not be exceeded.

BE WATER-WISE!

Outdoor water use accounts for 25–50% of the average home’s water. Here are a few water-saving tips you can use in your garden:

- Design the position and the shape of your gardens so you have groups of plants with similar water needs.

- Water at dawn rather than during the heat of the day when evaporation will waste water.

- Watering at dusk after a hot day may be desirable but moisture resting on foliage overnight encourages fungal diseases.

- Frequent, light watering encourages shallow roots, so aim for longer, infrequent watering that allows the top layer of soil to start drying out before watering again.

- Giving the lawn a proper drink, less often, encourages deeper root growth and means your grass will be more able to withstand heat stress and dry periods.

About 40% of all water used in the home is in the bathroom. Remember to keep you showers short, 4 minutes or less is recommended. Super efficient water users will save the water from baths or showers to use on the garden. Running taps use about 16L of water per minute...so turn the taps off.

Find more information on using water wisely in your home at: www.qld.gov.au/environment/water/residence/use/home

Financial Assistance

At Council's discretion, in line with Section 123 of the Local Government Regulation 2012, and Cloncurry Shire Council’s Revenue Statement, a rebate of 20% (to a maximum dollar amount of $200 per annum) of the gross rates and charges levied may be granted to aged, widowed, invalid or other pensioners who are eligible to receive the State Government Pensioner Rate Subsidy. This rebate complements the subsidy that is offered under the State Government’s Pensioner Rate Subsidy Scheme.

In line with State Government concessions, a 20% rebate will also be applied to the Emergency Management Levy (EML) for eligible Pensioners.

The eligibility of a pensioner to receive a Council pensioner rate remission will be determined in terms of the following criteria:

- The applicant/s shall be the holder of a Queensland ‘Pensioner Concession Card’ issued by Centrelink, on behalf of the Department of Communities, or a DVA Health Card (All Conditions within Australia) or DVA Health Card (Totally & Permanently Incapacitated) issued by the Department of Veterans’ Affairs.

- The applicant/s shall be the sole owner/s of the property or life tenants in terms of a valid will. Applicants who are part owners of a property shall receive a concession equal to the portion of ownership.

- The property for which the rate remission is being requested must be the applicant/pensioner’s principal place of residence, which shall not be income-producing in any way. Applicants who, due to ill health or incapacitation, are living in a nursing home or who are temporarily living with relatives or friends, shall qualify for the rate remission, provided the property remains non-income producing.

- The receipt by an eligible pensioner of a pensioner rate remission will not be dependent upon the pensioner ratepayer paying their rates by the due date of payment stated on the Rate Notice.

An application/registration need only be sought from pensioners when:

- Applying for the subsidy for the first time; or

- Council needs to re-establish eligibility (e.g. after having a qualifying concession card re-issued, changing the address of the principal place of residence, etc).

Council acknowledges the policies and procedures of the Queensland State Government Pensioner Rate Subsidy Scheme and ratepayer/s must meet these criteria to be eligible for the Council’s pensioner remission.

If you are eligible for the above rebate, complete the Pensioner Rate Subsidy/Concession Application Form and return to Council for review.

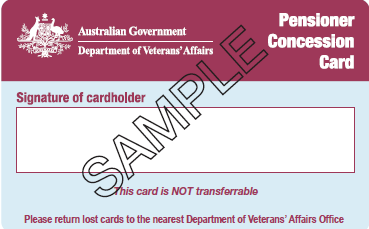

Pensioner Card Check

| ACCEPTABLE CARDS | |

|---|---|

| QLD Pensioner Concession Card issued by Centrelink |  |

| Veterans' Affairs Pensioner Concession Card |  |

| Veterans' Affairs Gold Card |  |

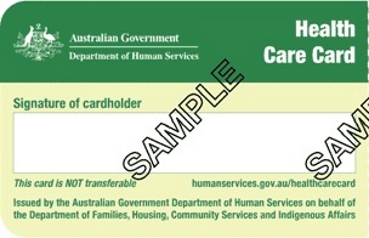

| NOT ACCEPTABLE CARDS | |

|---|---|

| Seniors Card |  |

| Health Care Card |  |

| Medicare Card |  |

To assist ratepayers in meeting their rate responsibilities, Council may accept applications for payment of overdue rates and utility charges by instalments in line with Council’s Rates and Debt Recovery Policy. Any such payment plan which Council agrees to must provide that all rates and charges are to be paid in full within one year from when the application is approved by Council. Each application will be assessed by Council on its merits.

Interest will continue to be charged on overdue rates and utility charges which are subject to an agreed instalment payment plan. The applicant must comply with the terms of the payment plan agreed to, as default will result in Council requiring immediate full payment of future instalments.

To apply for a Payment Plan, complete and return the Payment Plan Application Form and return to Council to begin the approval process.

In line with Section 119, of the Local Government Regulation 2012, a concession may be granted by Council for Rates and Charges for land if the required criteria are met. See Section 120 of the Local Government Regulation 2012, for more information.

The types of concessions are as follows:

- A rebate of all or part of the Rates and Charges

- An agreement to defer payment of Rates and Charges

- An agreement to accept a transfer of unencumbered land in full or part payment of the Rates and Charges

If you meet the required criteria for a concession on Rates and Charges, a Financial Hardship Application Form must be completed and submitted with all required documents prior to the concession being considered by Council.

Several options are available to you if you are suffering from extreme financial hardship. Below is a listing of some of your options to assistance with your situation:

- If you have a mortgage, discuss your situation with your mortgagee, as they may be able to pay your Rates and add the amount onto your mortgage.

- Superannuation; if you have any superannuation, you may be able to access your superannuation to pay your Rates. Special conditions apply. Access the Australian Taxation Office website for more information.

- Apply for Queensland Government Mortgage Relief Loan. Other useful information can be found on this website that may assist you.

- Useful links and contacts can be found on our Financial Assistance Information Sheet.

- If eligible, apply for a concession to be considered by Council using our Financial Hardship Application Form

Notices of Intention to Sell Land for Overdue Rates and Charges

Subject to Section 140 (2) of the Local Government Regulation 2012, Cloncurry Shire Council may, by resolution, decide to sell land with overdue rates and charges.

| # | Name | Size | Type | Download |

|---|